NACCIMA has expressed its approval of the suspension of the five percent Excise Tax on telecommunication services and the escalation of Excise Duty on locally manufactured products.

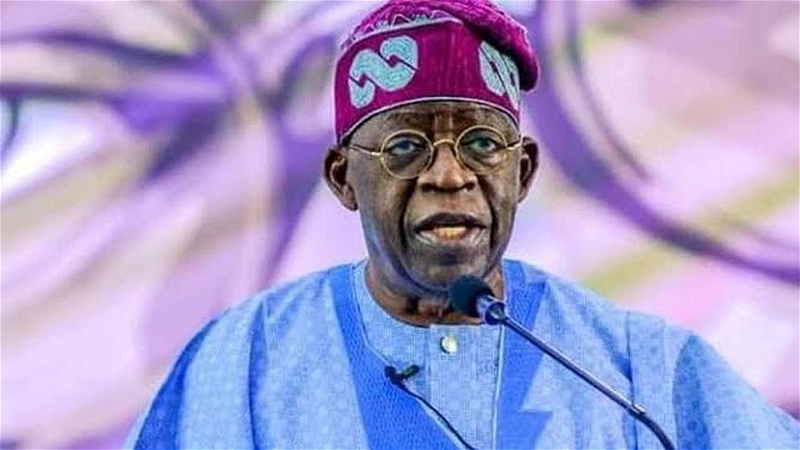

They believe that this action will alleviate the excessive burden on Nigerian businesses. Dele Kelvin Oye, the National President of NACCIMA, acknowledged the administration's dedication to preventing unfavorable policies from imposing undue hardships on Nigerian businesses.

It is acknowledged that the tax adjustments were designed to generate revenue and tackle crucial public health and environmental issues. Nevertheless, the insufficient advance notice and ambiguity surrounding the implementation of these changes have presented substantial difficulties for impacted businesses.

These challenges include escalating costs, diminishing profit margins, and underutilization of capacity.

We applaud President Bola Ahmed Tinubu's choice to enact executive orders that postpone the implementation of the tax modifications outlined in the Finance Act and Customs, Excise Tariff (Variation) Amendment Order.

Furthermore, we endorse the suspension of the 5% Excise Tax on telecommunication services, the escalation of Excise Duties on locally manufactured products, the Green Tax on Single Use Plastics (including plastic containers and bottles), and the Import Tax Adjustment levy on specific vehicles.

We encourage the Federal Government to maintain its engagement with stakeholders and enact business-friendly policies that foster sustainable economic growth. We firmly believe that the private sector plays a crucial role in attaining the government's objectives of increased GDP growth and decreased unemployment rates through the creation of employment opportunities.

Leave a comment